Energy and industry executives say that technology availability is the most important factor in accelerating their energy transition strategies — but they are also concerned about its risks. What will encourage them to invest in it?

Society faces an energy trilemma: we need access to energy that is secure, sustainable and affordable. To solve it, we will need to expand and diversify lower-carbon sources of energy, which means scaling up new and mature means of generation, fuels and decarbonisation technology.

New research from Baker Hughes, the annual Energy Transition Pulse survey of 555 business leaders from energy and industry across 21 countries, finds that the availability of technology has become the most important factor in accelerating the energy transition.

Improvements to energy efficiency through existing infrastructure or proven upgrades can be a quick way for companies to reduce their carbon emissions. But to really make a difference, energy and industry need to focus on deploying more decarbonisation technology. Financing and supply chain constraints in the aftermath of the pandemic constitute a barrier, and de-risking new technology and large infrastructure continues to be a challenge for many businesses.

Technologies are emerging too slowly

According to the International Energy Agency (IEA), “Several emerging technologies saw encouraging progress, but these positive trends need to accelerate rapidly over the current decade to achieve deployment levels in line with a net zero by 2050 trajectory.” [1]

Critical to speeding up this process are new value chains — for example for carbon capture, utilisation and storage (CCUS) — and new ecosystems around alternative fuels, such waste-to-energy and hydrogen.

Ilham Kadri, CEO and president of the executive committee of Solvay, which has successfully commercialised new waste-to-energy value chains to replace coal in two of its European plants, says that these new ecosystems are a win-win for Solvay and the company’s stakeholders.

Greater use will lower costs

Commercialising technology is an important part of scaling up its use. As technologies and fuels become more widely used, their costs will come down, which in turn will encourage greater demand.

This is what has happened with solar and wind power over the past decade. Between 2010 and 2019, the cost of solar PV globally dropped by 82 per cent.[2] The IRENA cost study found that continuous technology improvements and greater economies of scale played a part in this deflation by reducing manufacturing costs.

Meg O’Neill, CEO of Woodside Energy, recalls how consistent investment in renewable power sources, such as wind and solar, reduced the cost of deployment over time, and expects something similar will need to happen for new lower-carbon energy sources, technologies, and energy carriers such as hydrogen.

“Technology is going to be imperative to start driving down the cost of the elements required to make the energy transition viable,” she says. “Over the last few decades, we’ve seen the cost of solar panels decrease dramatically. Now we need to apply technology to ensure that other energy transition opportunities are also cost competitive.”

Mark Nelson, EVP strategy, policy and development at Chevron, says that much more work needs to be done before hydrogen, for example, can make a bigger contribution to decarbonisation. “We need more technology development that helps with the cost of manufacturing and transportation,” he says. “We're also working hard on the economies of scale, which will help the transportation of hydrogen.”

What is holding back investment in transition technology?

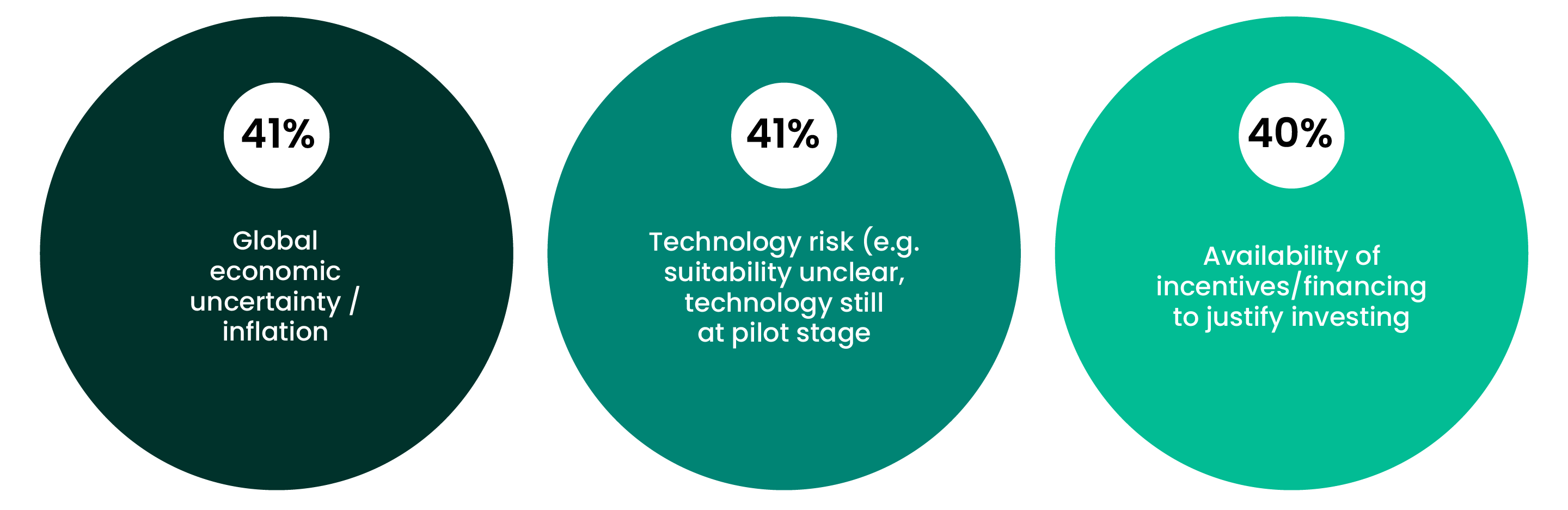

Baker Hughes’ survey finds that the risks of technology, combined with the gloomy economic outlook, are holding back investment in the energy transition.

Economic uncertainty, technology risk and financing are the top three barriers to investing in energy transition technology

What are the three greatest barriers or challenges to your organisation investing in energy transition technologies?

How to encourage business to make a move

Companies will look to first movers for reassurance, but those first movers will want some security and return on their investments in new fuels, decarbonisation technologies and infrastructure. Offtake agreements, new partnerships and purposeful policy support are three ways to de-risk technologies and incentivise investment.

Offtake agreements

Offtake agreements reduce the financial risk of large infrastructure projects for both producer and purchaser: funding is secured, and there is a guaranteed market and supply and a fixed pricing structure.

According to Baker Hughes’s chairman and CEO Lorenzo Simonelli, new business models will be crucial for liquefied natural gas (LNG) infrastructure to be scaled up. “There’s plenty of resource available, but we need to create the right financing mechanisms,” he says. “For example, LNG offtake agreements are normally 20 years long, but some companies will only need supply for five years. We need new, flexible commercial models to allow projects to progress.”

New partnerships

For hydrogen and CCUS, partnerships and cross-sector collaboration will create new ecosystems to help monetise decarbonisation processes. For example, the Bayou Bend carbon capture and storage project has come out of a partnership between Chevron, Talos Energy and CarbonVert. Announced in May 2022, it will be the first project of its kind in the US to sequester carbon from industrial facilities.[3]

“We’re bringing together technology companies, infrastructure companies and emitter companies to create hubs,” says Chevron’s Mark Nelson. “You’ve got to keep advancing the technology, you need to get the right group of people together, and you need policy support to accelerate forward.”

Policy support

Policy support for emerging technologies can also create substantial shifts in adoption. The Inflation Reduction Act passed by the US government in August 2022, for instance, includes tax credits for green hydrogen that could halve its cost in some locations. [4]

“Policies like the Inflation Reduction Act in the United States have done wonders to spur on hydrogen,” says Simonelli. “If you look at the $4bn that's going to be incentivised, that essentially makes green hydrogen competitive today.”

Despite the uncertainty in energy markets and worldwide fears of recession companies must persevere and continue to invest in energy transition technology and enable growth in CCUS, biofuels, geothermal, hydrogen, LNG – and all the other solutions needed to balance the energy trilemma.

Content produced by FT Longitude, the specialist marketing & research division of the Financial Times Group.

Footnotes

- [1]https://www.iea.org/news/clean-energy-technologies-need-a-major-boost-to-keep-net-zero-by-2050-within-reach

- [2]https://www.irena.org/publications/2020/Jun/Renewable-Power-Costs-in-2019

- [3]https://www.chevron.com/newsroom/2022/q2/chevron-talos-and-carbonvert-announce-closing-of-joint-venture-expansion

- [4]https://www.ft.com/content/249a3412-dfeb-40e5-a147-77cc5d4d0689

Energy Forward Stories

Sign up to stay up to date on the latest innovations and people shaping the future of our industry.